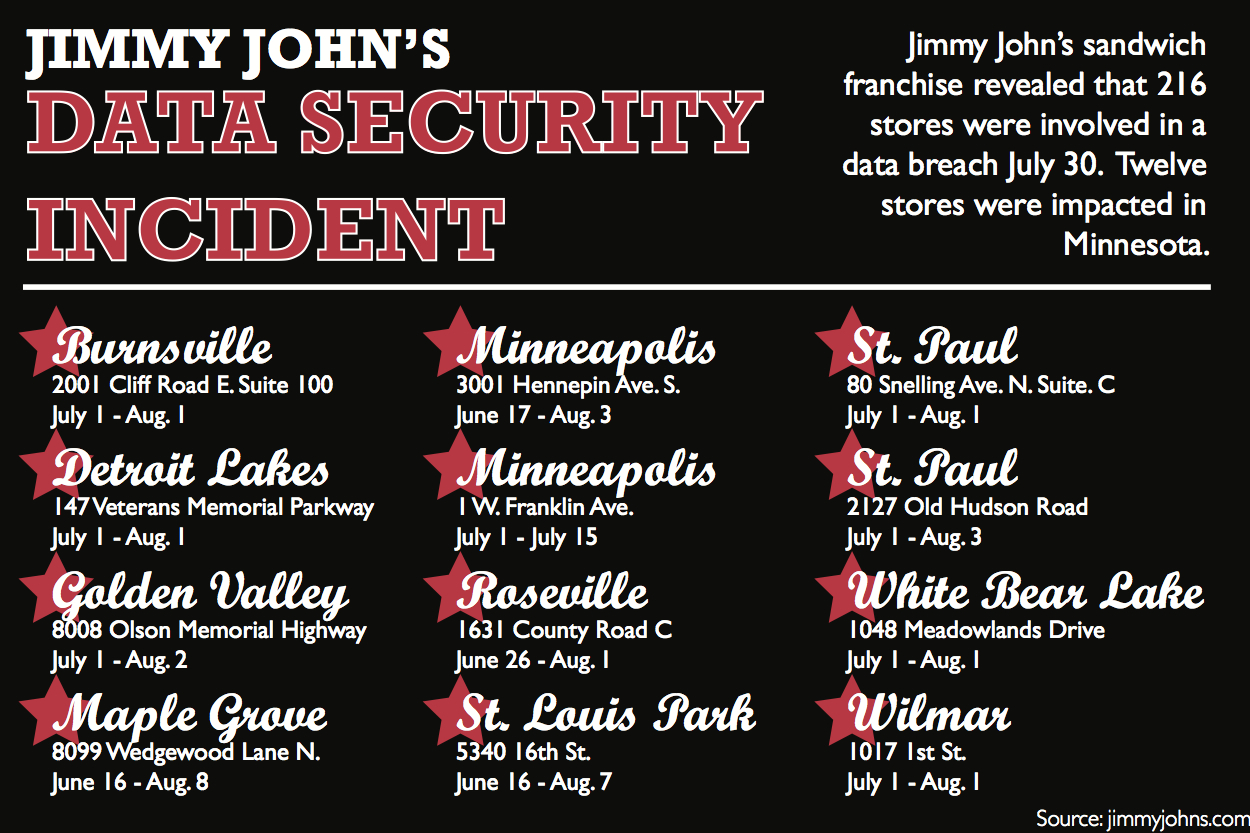

Jimmy John’s sandwich franchise revealed that 216 stores were involved in a data breach July 30, including the Snelling Avenue branch, resulting in customers’ credit card information being compromised.

The press release published on Sept. 24 stated that Jimmy John’s learned of the breach on July 30, and that customers who swiped their cards in-store between June 16 and Sept. 5 are at risk. Jimmy John’s has hired a third party to investigate and claims the breach has been contained.

Business finance professor Thadavillil Jithendranathan said while customers are not at risk of having to front the bill from identity theft, Jimmy John’s is likely to see a drop in business.

“Generally the students, or whoever has a compromised credit card, don’t have to pay anything out of their pocket,” Jithendranathan said. “For the company, it’s a significant problem because customers will be concerned about the safety of using credit cards, which means that they might take their business somewhere else. That is a real business problem.“

An increasingly common threat, this latest security issue follows a massive data hack on Target’s system. Sophomore Jessie O’Brien had to cancel her credit card after her information was compromised in the Target breach last winter.

“A bunch of credit card numbers got hacked, and I know mine did and two of my friends,” O’Brien said. “We all had to get new credit cards.”

O’Brien said she thinks that students who use cash will keep buying Jimmy John’s sandwiches but should remain cautious when making purchases with a card.

“Just be smart about where you spend your money and who you talk to,” O’Brien said. “I think customers like to be safe about their money, so I bet business will go down a little bit.”

Freshman Matt Harein is a weekly Jimmy John’s customer and has noticed an increase in credit card security issues.

“It seems like it’s becoming more and more of a crime that’s harder to stop. People are getting better at it,” Harein said. “That’s kind of a big deal if you don’t get on top of it.”

While Harein said he personally isn’t concerned as he consistently pays with cash, he thinks customers who use their cards should be worried.

“If I would have gone there and used my credit card, I would have been worried,” Harein said. “Just stay on top of your billing information, and make sure there’s no weird purchases and things like that.”

Jimmy John’s has increased data security by installing encrypted swipe machines, enhancing systems and reviewing its policies and procedures for its third-party vendors, according to the press release.

Jithendranathan said these breaches are mostly an American problem because the United States’ credit card system is out of date.

“We are still using the old fashioned magnetic tape,” Jithendranathan said. “Other countries are using a chip in their credit cards, and that is much more secure.”

For now, Jithendranathan said customers at risk should not worry too much about having to pay for fraudulent charges.

“They are not really at risk because any loss due to data breach; that is an issue for the firm that caused this problem,” Jithendranathan said. “It’s not the individual card user. They are protected.”

Simeon Lancaster can be reached at lanc4637@stthomas.edu.