Students’ federal financial aid dollars remain in limbo after sequester budget cuts took effect March 1. Definitive information about cuts that would affect the Federal Supplemental Educational Opportunity Grant and Federal Work Study, remains unknown.

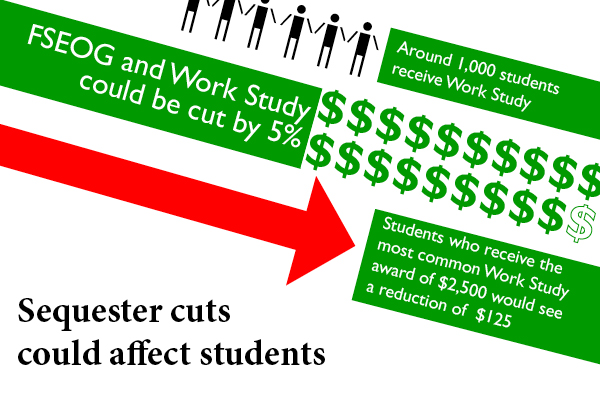

If the cuts are made, FSEOG and Work Study could be cut by 5 percent. Students who receive the most common Federal Work Study award of $2,500 would see a reduction of $125, Director of Admissions and Financial Aid Kris Roach said.

The Department of Education has not yet provided exact information on if or when cuts would apply.

Roach said hundreds of St. Thomas students receive FSEOG and around 1,000 receive Federal Work Study.

Sophomore Sarah Al Munayea said the combination of increasing college expenses and cuts could place a burden on students.

“A lot of universities are increasing their tuition fees so if they do that, then I think (the cuts) are going to affect students who have to pay more (out of pocket),” Al Munayea said. “A lot of (students) already have to pay loans back, so I think it would affect a lot of students.”

Senior Eric Tietjen said the financial burden the cuts might place on students would vary.

“I think it just depends on each person’s individual financial situation,” Tietjen said. “I personally know people that it would affect a lot and others who wouldn’t really mind too much.”

Origination fees on student loans will also require students to fork out more money, as they have been confirmed to increase. The Department of Education has confirmed a .05 percent increase in the origination fees for Stafford Loans and an amendment to PLUS loan origination fees that increases them from .02 percent to .204 percent.

Roach said the reductions may be small, but they can have a big impact because many of the cuts are directed at programs that help students with financial needs.

“I am of the mindset that while these reductions are small in size, they may be meaningful for students and parents. Can they be dealt with and managed? Yes,” Roach wrote in an email to TommieMedia.

Junior Kyu Lee said because the cuts affect students with financial need, she said it could pose a problem for those students paying their total tuition.

“There’s a possibility, a worst case possibility, that people might drop out because they can’t afford that extra money,” Lee said.

One positive aspect of the cuts is that they will not affect Pell Grants, which Roach said are awarded to the students with greatest financial needs. Pell Grants remain the same throughout the 2013-2014 year, but the future of the grants beyond that remains unknown.

Al Munayea said she hopes the Office of Financial Aid would do something to help students if the cuts were to take place.

“I know St. Thomas is one of the universities that is going to increase their tuition fee,” Al Munayea said. “I think they should maybe provide students with like a grant or a scholarship, not a full one, but something to help a little bit with that extra money they will be paying.”

The Financial Aid Office would try to help students affected by any cuts as much as possible, Roach said.

“We would consider special circumstances and hardships created by such changes to the extent that our budget allows us to do so,” Roach said. “We would try to help students with student employment from either the State of Minnesota or directly from St. Thomas.”

Tietjen said he doesn’t think St. Thomas should be held responsible for helping students with cuts that could be seen as small.

“(St. Thomas) gives out a lot of scholarship stuff as it is, so if it’s something that’s only a couple hundred, I personally wouldn’t expect them to (compensate for budget cuts),” Tietjen said. “I feel like they do a lot.”

Roach said financial aid counselors are more than willing to help students figure out their financial situations in the midst of the sequester.

“The bottom line is that each student has a personal financial aid counselor who is eager to help students figure out the nuances of the sequester and their financial aid and financing options,” Roach said.

Gabrielle Martinson can be reached at mart5649@stthomas.edu.