President Barack Obama said in a conference call to college journalists Tuesday, April 24, that Congress’ failure to freeze the interest rate for federal student loans, which will double on July 1, would be “nothing more than cutting our own future off at the knees.”

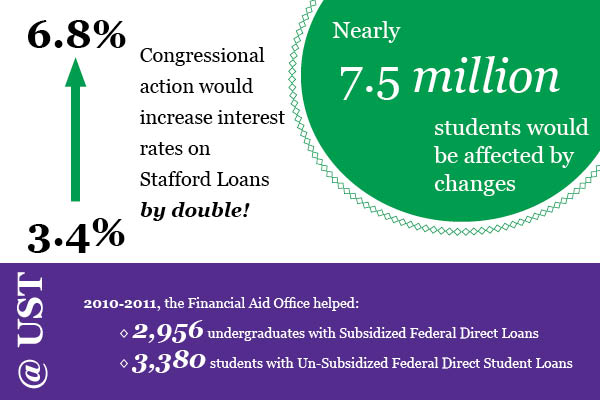

Obama said that without congressional action, the current interest rate on Stafford loans would double to 6.8 percent, leaving nearly 7.5 million students owing more on their loan payments.

“For the first time now, we’ve got Americans owing more debt on their student loans than they do on their credit cards,” Obama said. “(Higher education) is an economic imperative that family has got to be able to afford.”

Director of Admissions and Financial Aid Kris Roach said that about one-third of St. Thomas undergraduates rely on federal student loans to make their college education possible, but even a double interest rate would be lower than it has been historically.

“Obviously, if the rates double our students will pay more in interest upon entering repayment,” Roach said. “While 6.8 percent seems like a healthy interest rate, it is significantly less than some of us paid for our student loans, and it is lower than credit cards and other private students’ loans.”

Sophomore Anne Michael said that if interest rates double, she might have to look for other ways to help finance her education.

“I think I might be more inspired to look for scholarships to reduce my amount of loans,” Michael said. “It’s something I think a lot of us would just have to suffer through unless it’s passed.”

Obama said college students shouldn’t have to struggle to get by while a minority of Americans prosper.

“We can’t let America become a country where… you’ve got fewer ladders for people to climb into the middle class and get opportunity,” Obama said. “We’ve got to build an economy where everybody is getting a fair shot; everybody is doing their fair share, and everybody is playing by the same set of rules.”

Junior Rachel Lee said she has very few federal loans, but a doubled rate could have a significant impact on students who are already struggling.

“When students find out that interests rates are so high for their students loans, it’s going to deter people from wanting to apply for college,” Lee said.

Obama encouraged college students to voice their concerns about the issue.

“From my perspective, this is a question of values,” he said. “Let Congress know that they need to do the right thing.”

According to White House press releases, the interest rate increase would cost college students, on average, an additional $1,000 over the lifetime of the loan, but congressional action to freeze rates would only be in effect for a year before expiring again.

Roach said she believes that both Obama and republicans who have introduced legislation to stop the rate increase are using a short-term measure to their benefit.

“The democrats and republicans are both using this as a tool to attract college-age voters while working on other projects that are important to their respective parties,” she said.

For college students like Michael, the prospect of interest rates doubling only adds to the reality that going to college carries a high price tag.

“I think paying off student loans will take a lot longer than I expected,” Michael said. “Maybe by the time I’m 90.”

Heidi Enninga can be reached at enni5264@stthomas.edu.

Graphic designed by Katie Souba.