The University of St. Thomas used to offer students a health insurance plan, but the Affordable Care Act’s regulations have reduced demand, so the university stopped offering it to students. Now, premiums are rising nationwide, and everyone is feeling the impact.

Madonna McDermott, executive director of health, wellness and counseling, said when the university first offered a health insurance plan, it was inexpensive but not a great product. The university then refined the plan, and about 1,000 students were covered.

“We kind of changed what our expectation was of the insurance plan, such as covering things like pre-existing conditions, injuries and accidents, prescriptions,” McDermott said.

When the Affordable Care Act was established in 2010, it mandated health insurance for all students. McDermott said this regulation cut original demand that came from requirements specific to St. Thomas students.

“Then it became federal law that all students had to have insurance. Before that… private colleges pretty much said you have to have insurance,” McDermott said. “So it was our own internal requirement, and then it became federal law. So we were kind of duplicating what the federal law was doing.”

The Affordable Care Act also created a policy which allowed children to stay on their parent’s insurance plans until age 26. With many students then being covered under parents’ plans, the demand for student insurance plans dwindled.

“Students could go back on their parents plan or stay on their parents’ plan until 26,” McDermott said. “Because fewer and fewer students were covered, the cost of it actually was going up.”

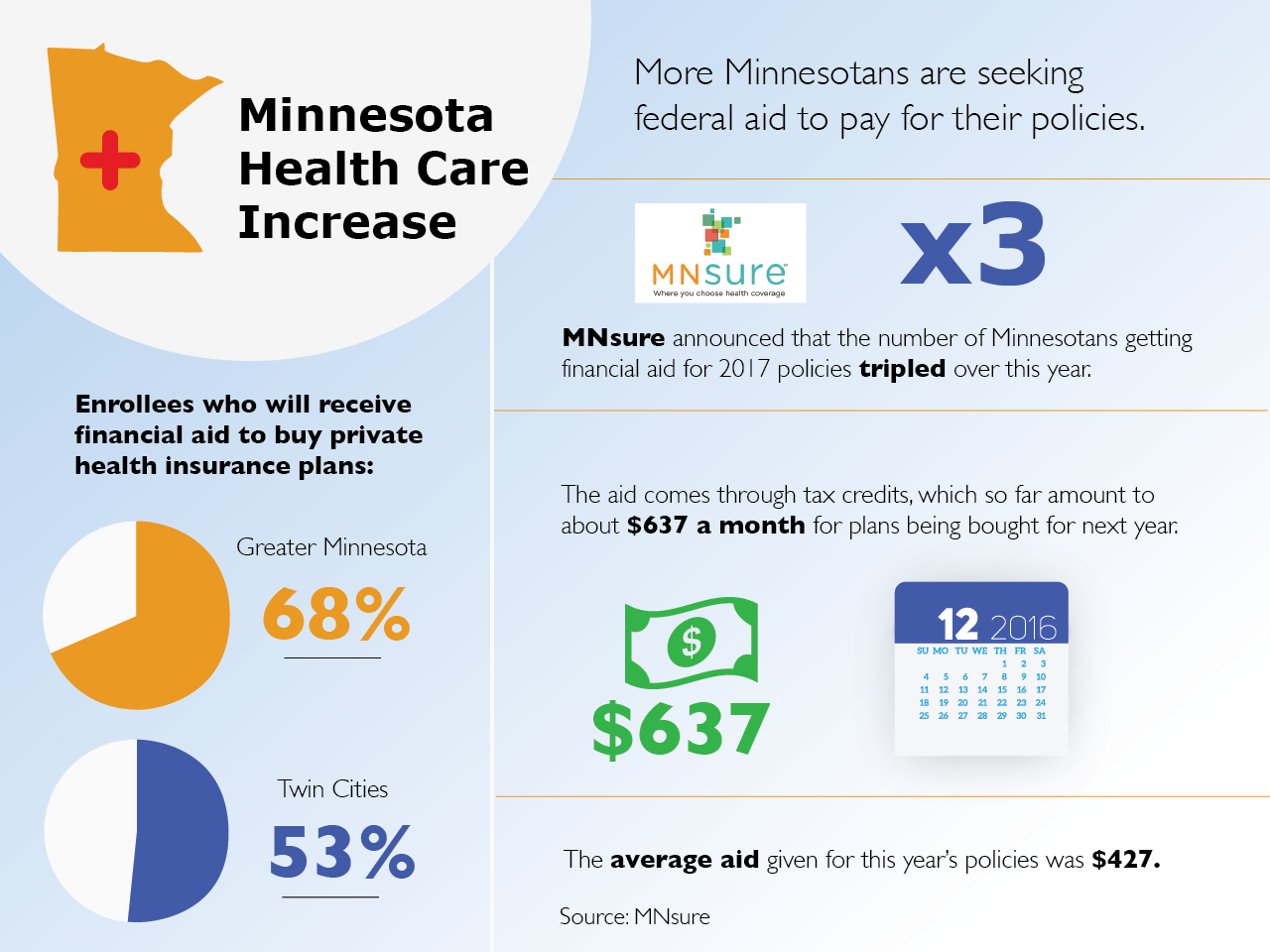

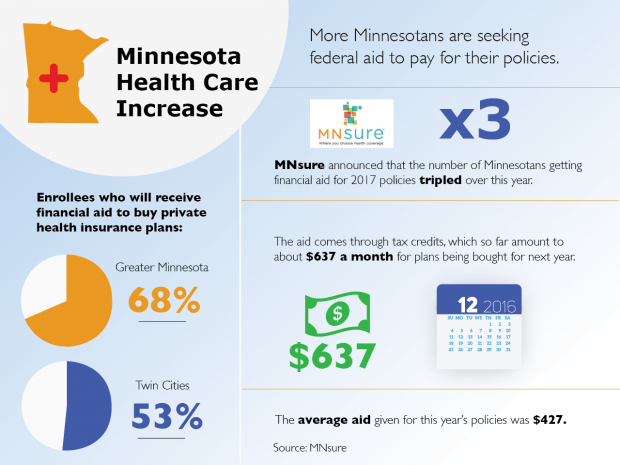

As premiums rise, the number of Minnesotans asking for federal aid has tripled, according to MNsure.

McDermott said in the last couple years the plan was offered, only a few hundred students were covered and the price was the same as outside insurance plans, so a year ago, the university decided to stop offering it to domestic students. Although the university no longer offers a health insurance plan, there are still many resources that help students to finding insurance plans.

“For students, we do have an insurance office here,” McDermott said. “For those that are experiencing challenges, we’ll work with them with their own insurance company … helping them figure out how to do this as well as the stuff that’s online.”

Sophomore Alex Jensen believes that offering a health insurance plan would reduce the stress of students who aren’t covered by their parents with insurance rates rising.

“There are some students who don’t have the luxury of using their parent’s health insurance for whatever reason,” Jensen said. “But I do think it’s helpful for them to give students the resources to get insurance.”

Though many students may be impacted by the rising health insurance prices, McDermott believes everyone is feeling the effects.

“I think it’s impacting everybody,” McDermott said. “It’s a problem across the country.”

Kassie Vivant can be reached at viva0001@stthomas.edu